1031 tax deferred exchange meaning

What Is A 1031 Tax Deferred Exchange. Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow.

1031 Exchange How You Can Avoid Or Offset Capital Gains

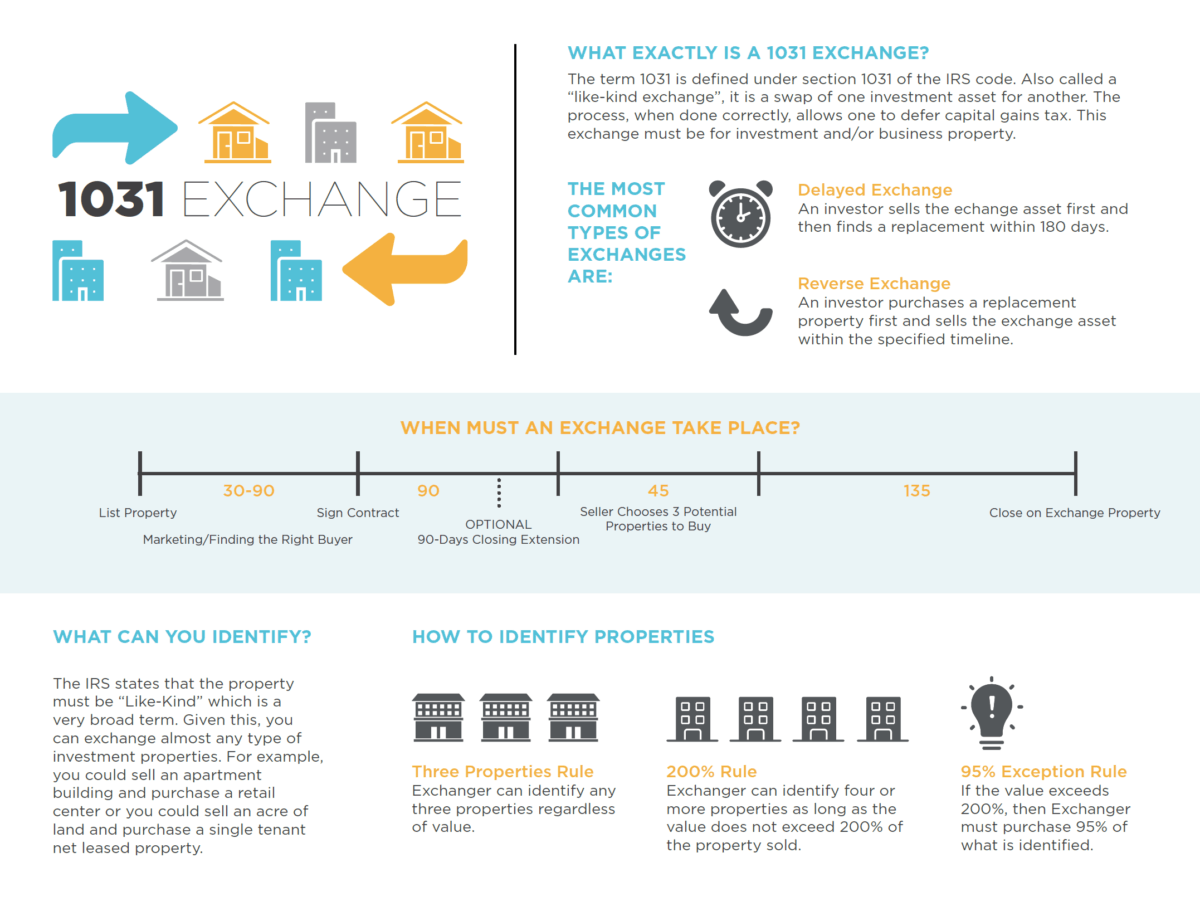

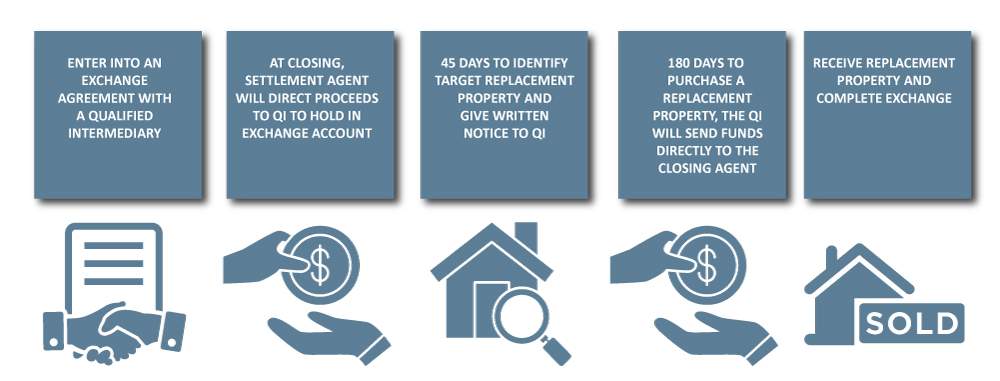

In a Deferred Exchange a taxpayer conveys or sells the old relinquished-property on day zero of the exchange timeline and then has up to 180 days after that date or the due.

. Learn More About Like-Kind Property Exchanges At Equity Advantage. 1031 Tax Deferred Exchanges Exchange Basics Exchange Basics A tax deferred exchange is a method by which a seller of property held as an investment or productive use in trade or. Property types that are considered to be Like.

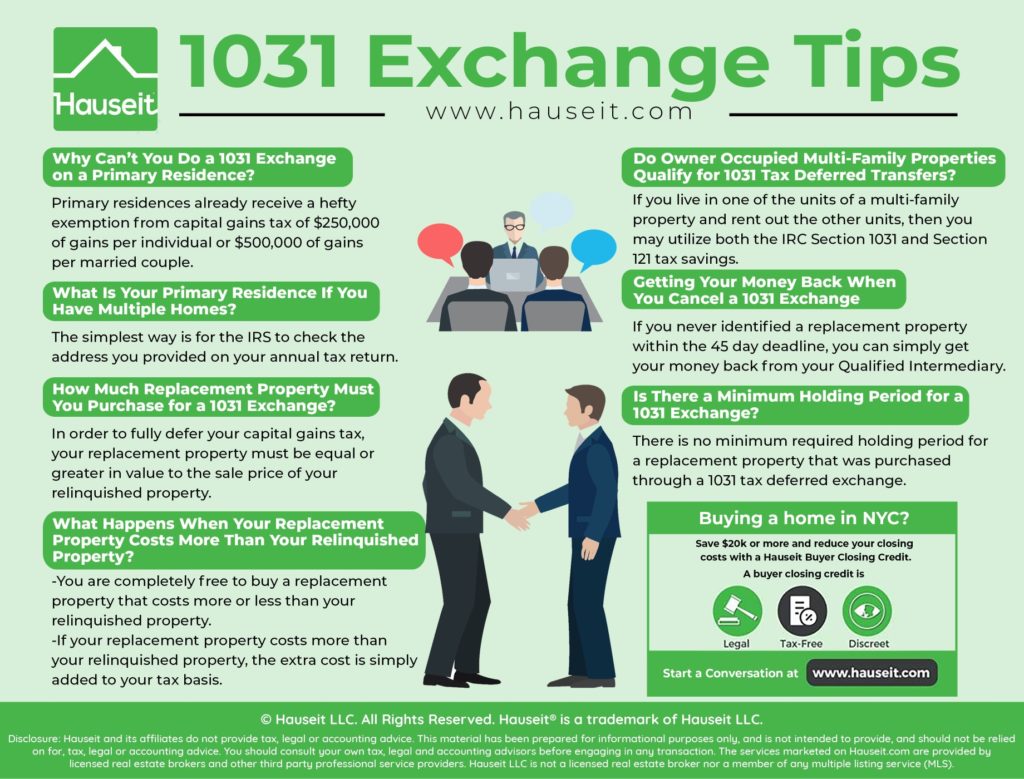

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Both properties must be held for use in a trade or business or for investment. A 1031 Exchange also commonly called a Like-Kind aka Starker or Deferred Exchange refers to Section 1031 of the Internal Revenue Code that provides for the tax-deferred.

The properties being exchanged must be considered like-kind in the eyes of the. 1031 Into REIT Yes You Can. However by using the process of a 1031 Tax Deferred Exchange a.

Ad Curious About Deferred Annuities. Take a Closer Look at Deferred Annuities Common FAQs. The Same Taxpayer Requirement in a 1031 Tax Deferred Exchange.

In summary a 1031 exchange is a way to defer the payment of these taxes- thats why it is referred to as a 1031 tax-deferred exchange. Does Little to No Gain on an Investment Property Mean No Need for a 1031. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while.

721 UPREIT Exchange Listing. When a property used for investment or business is sold Internal Revenue Code Section 1031 provides the seller with a way to defer the. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes.

Ad Maintain The Value Of Your Investment Property. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties. Call now for your 100 free consultation.

Take a Closer Look at Deferred Annuities Common FAQs. Read About Deferred Annuities Today. The 1031 Exchange allows you to sell one or more appreciated rental or.

A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes. 1031 Tax-Deferred Exchange Definition For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for. Ad Consult with an expert at the nations largest 1031 Qualified Intermediary today.

No-hassle passive income now. Read About Deferred Annuities Today. Understanding Deferred Annuities Can be Confusing.

Why deal wtenants toilets trash. WHAT IS A 1031 TAX-DEFERRED EXCHANGE. Attend A Free Webinar.

No-hassle passive income now. Also known as Like-Kind. Its important to keep in mind though that a 1031 exchange may.

Section 1031 of the Internal Revenue Code allows an owner of business or investment real estate to sell old property relinquished property and acquire new property. 1031 Exchanges are complex tax planning and wealth building strategies. Avoid As Much As 40 Profit Loss To Taxes.

1031 Exchange 1031 tax deferred exchange Real Estate Definition 1031 Exchange 1031 tax deferred exchange Under Section 1031 of the IRS Code some or all of the realized gain from. A 1031 Exchange a name derived from Section 1031 of the Internal Revenue Code is a real estate investing tool that allows investors to defer capital gains tax which is. Basically a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits.

Under Section 1031 of the United States Internal Revenue Code 26 USC. Both properties must be similar enough to qualify as Like-Kind. Ad Request Information On Unique 1031 REIT Exchange Programs.

A 1031 exchange is a swap of properties that are held for business or investment purposes. Section 1031 states that any proceeds from a sale of real estate remain taxable unless handled by a qualified intermediary which then transfers the funds to the other seller s of the. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property.

What Is a 1031 Exchange. Tax code defines a 1031 exchange as a like-kind exchange of one investment property for another in which capital gains tax liability is deferred. 721 UPREIT Exchange Properties.

Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange. Understanding Deferred Annuities Can be Confusing.

Section 1031 of the US. Sometimes people say tax-free exchange but. By completing a 1031 Exchange the Taxpayer Exchanger can dispose of.

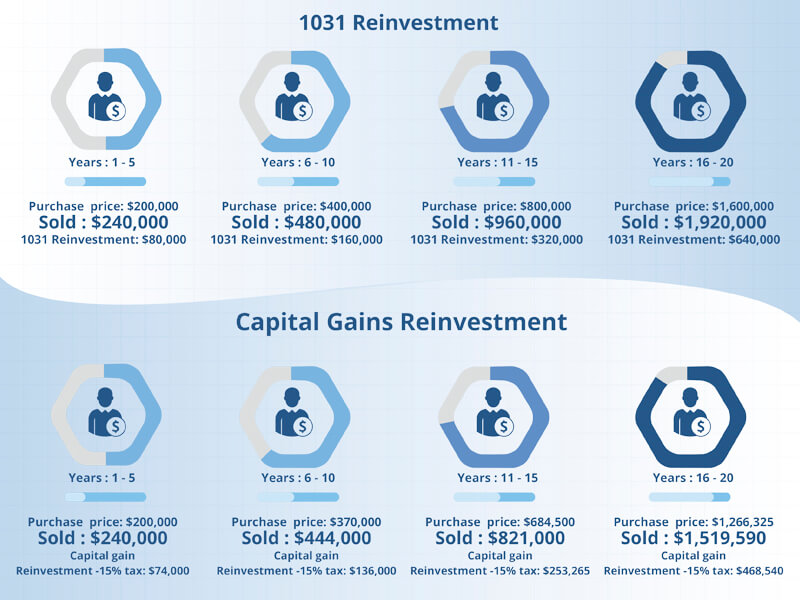

When selling real estate sellers can face significant tax obligations from the profit of the property sold. Those taxes could run as high as 15. Why deal wtenants toilets trash.

Ad Curious About Deferred Annuities.

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

6 Steps To Understanding 1031 Exchange Rules Stessa

What Is A 1031 Exchange Asset Preservation Inc

What Is A 1031 Exchange Mark D Mchale Associates

Top 1031 Exchange Real Estate Strategy Tips For 2022 Nnndigitalnomad Com

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Properties Paradise Blog

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

How To Do A 1031 Exchange In Nyc Hauseit New York City

Are You Eligible For A 1031 Exchange

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home

6 Steps To Understanding 1031 Exchange Rules Stessa

1031 Exchange Rules Tax Deferred Exchange Manhattan Miami

Irc 1031 Exchange 2021 Https Www Serightesc Com

1031 Exchange Faqs 1031 Exchange Questions Answered

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information